Views: 203 Author: SENHEDA WOOD Publish Time: 2025-10-27 Origin: HONG KONG SENHEDA WOOD LIMITED

Content Menu

● I. Core Pain Points of the Philippine Market: Dual Pressures on Raw Materials and Compliance

>> 1. Insufficient Domestic Resources, High Dependence on Imports

>> 2. Escalating Compliance Thresholds for Exports

● II. Three Core Advantages of Okoume Adapting to the Philippine Market

>> 1. Stable Supply with Full Compliance Guarantee

>> 2. Suitable Performance with Controllable Processing Costs

>> 3. Stable Prices Meeting Cost-Effectiveness Needs for Exports

● III. Choose the Right Supplier to Unlock Okoume's Maximum Value

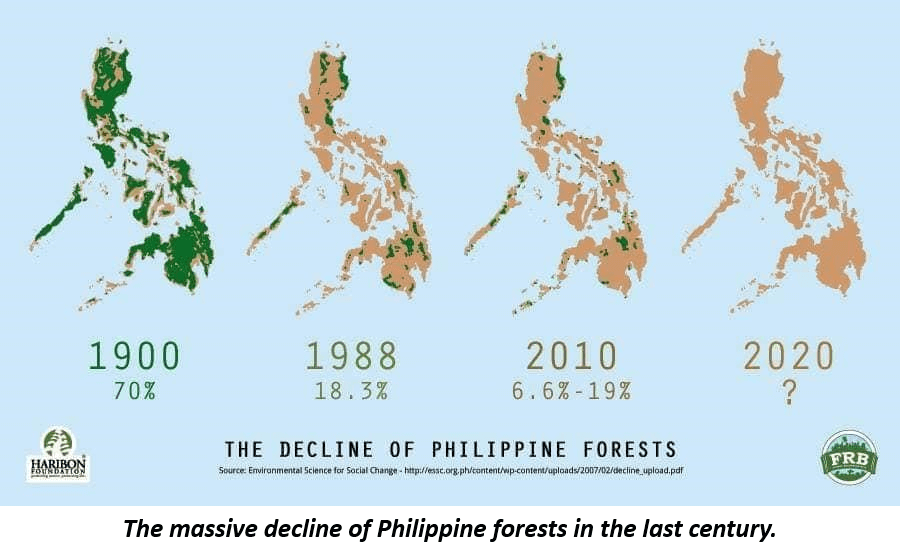

The Philippine timber industry is confronting dual challenges: "export growth alongside raw material shortages". As an emerging powerhouse in Southeast Asia's wood-based panel exports, its plywood, furniture, and related products have been steadily expanding their share in European and American markets (the 2022 Revealed Comparative Advantage Index (RCA) for wood-based panels has reached a moderate advantage). However, constraints on domestic forest resources have resulted in an annual timber demand gap of over 40%, with 80% of raw materials relying on imports. Among the various imported timber species, Okoume (Aucoumea klaineana) has emerged as a core choice for Philippine processing enterprises, thanks to its superior compliance, adaptability, and cost-effectiveness.

Despite a 23% forest coverage rate in the Philippines, only 30% of its forests are commercially exploitable. The annual output of legal timber stands at a mere 1.2 million cubic meters, far below the annual demand of 2 million cubic meters. Export-oriented industries such as furniture manufacturing and plywood production have long relied on imported raw materials like Malaysian rubberwood and Indonesian hardwood. In recent years, neighboring Southeast Asian countries have successively tightened their raw log export policies; coupled with fluctuating shipping costs, the stability of raw material supply has become a major concern.

The EU's Regulation on Deforestation-free Products (EUDR) officially took effect at the end of 2025, requiring timber and wood products entering the EU market to provide proof such as GPS coordinates of felling sites and full-chain traceability documents. As a key supplier of furniture and plywood to the EU, the Philippines will risk losing access to this core market if its raw materials fail to meet compliance requirements. Most low-cost timber species, lacking FSC certification and traceability systems, can no longer meet export standards.

Gabon, the primary producer of Okoume, holds reserves of 130 million cubic meters, accounting for over 90% of global supply. In 2024, Gabon's total timber output reached 4 million cubic meters, with Okoume accounting for 58%. More importantly, Gabon established a 25-year logging cycle system as early as 2010 and launched the "Log Certification and Traceability System", realizing full-process barcode tracking from felling to export. This system was recognized as compliant with the EU Timber Regulation (EUTR) in 2021. Currently, the FSC certification coverage of Okoume in Gabon exceeds 60%, fully meeting the compliance requirements for Philippine enterprises exporting to the EU.

As one of the world's most important timber species for plywood rotary cutting, Okoume features fine grain, light weight, excellent rotary cutting performance, and superior adhesion. These properties perfectly align with the demand for plywood—the core export product of the Philippines. Its low processing difficulty and minimal tool wear significantly reduce production energy consumption for small and medium-sized enterprises (SMEs). Compared with hardwoods like Sapele and Teak, Okoume can cut processing costs by 15%-20%, making it an ideal fit for the Philippine industry structure dominated by SMEs.

The international market price of Okoume has long been lower than that of similar hardwoods. In 2023, the price of Okoume logs ranged from 300 to 500 USD per cubic meter. With Gabon's timber output expected to grow by 50% in 2025, the increased supply will further stabilize prices. For Philippine enterprises, using Okoume not only meets the quality requirements for "compliant timber" in European and American markets but also maintains the price competitiveness of end products, creating an export advantage of "high quality at a reasonable price".

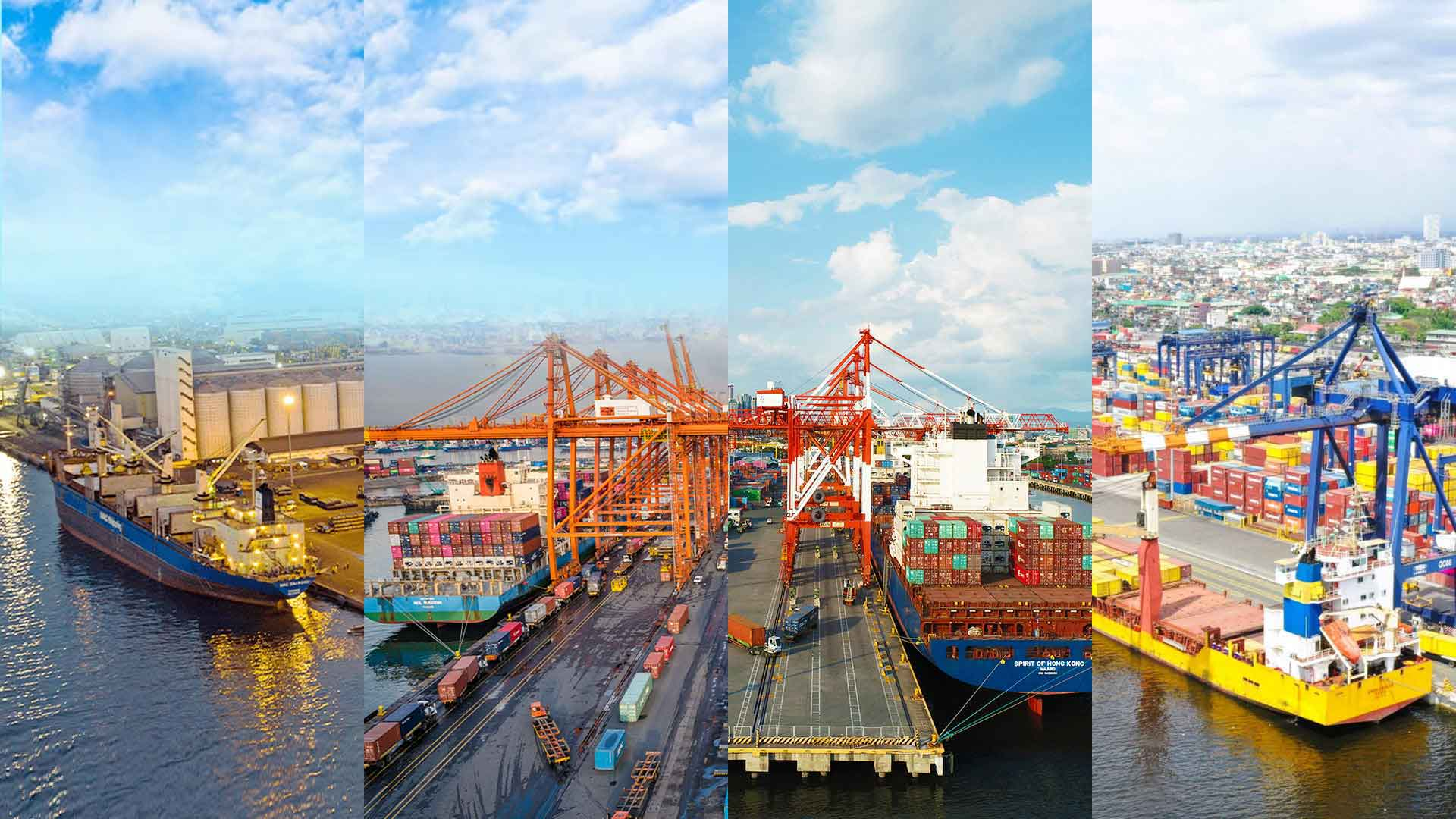

The realization of Okoume's market advantages hinges on supply chain stability. Philippine enterprises should focus on three key factors when purchasing Okoume: first, whether the supply comes directly from formal plantations in Gabon to avoid intermediate price markups; second, whether the compliance documents are complete; third, whether the logistics cycle is controllable (the stable shipping cycle from Owendo Port in Gabon to Manila Port is approximately 35-45 days).

As an enterprise deeply engaged in African timber trade, we have direct access to processing bases in the Nkok Special Economic Zone of Gabon, providing full-range Okoume products from logs to veneers:

· Supply Guarantee: 100% direct supply from Gabon, with an annual supply capacity exceeding 50,000 cubic meters and inventory turnover maintained within 30 days.

· Complete Compliance: Accompanying documents include FSC certification, felling traceability documents.

· Customized Services: Dried Okoume with moisture content < 16% can be provided according to requirements, suitable for scenarios such as plywood production and furniture manufacturing.

For the latest Okoume quotation, compliance document samples, or supply solutions, please feel free to contact us. We will help you seize the market opportunities in Philippine timber processing and exports!

Unveiling Mashonaste Wood: The Hidden Gem of South American Timber

Professional Q&A on African Movingui Wood - Hong Kong Senheda Wood Limited

Worry-Free Cross-Border Timber Procurement: Choose SENHEDA WOOD

Umbila: Value Analysis And Application Guide of A Rare African Hardwood

Wenge Has Become A Star Material in The Global Timber Market

Balsamo Wood: Nature’s Timeless Masterpiece for Luxury Craftsmanship